Conventional home loans have a lot of their own advantages despite the requirement of a higher credit score.

First, there is no required up front mortgage insurance as there is with an FHA.

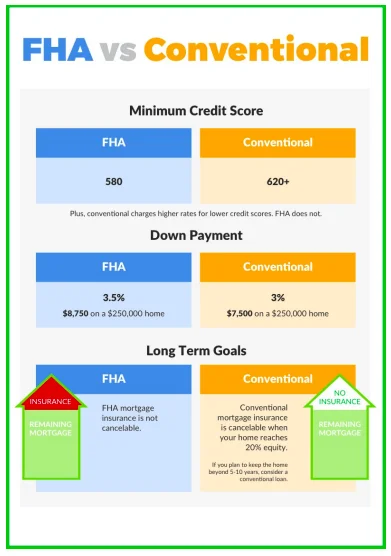

Secondly, if the home buyer borrows less than 80% of the value (20% or more down payment) then a mortgage insurance premium isn’t required. In many cases, by having the money available upfront, the homebuyer may have lower monthly payments than an FHA loan with the minimum down payment. the minimum down payment.

Conventional loans can be fixed-rate or adjustable rate and depending on the length of the mortgage, specific ones may prove to be better.

A fixed-rate mortgage has an interest rate that won’t change for the life of the loan.

Adjustable Rate Mortgages (ARMs) feature a fixed interest rate for a small period of time, typically 3 to 10 years, and then fluctuate up or down for the subsequent years. ARMs are typically sought by people who plan on moving from the house within a few years.

If the homebuyer doesn’t place 20% or more for the down payment, private mortgage insurance (PMI) can be eliminated when the loan to value is paid down below 80%.

Conventional loans can also be used to borrow a greater amount than FHA loans and can also be used to purchase investment properties and second homes.

Conventional Loans have