The U.S. Department of Agriculture created the USDA housing program to help farmers and low income families in rural parts of the country become homeowners

In order to be eligible for a rural development loan you must buy a property located in an eligible rural location. If you plan on purchasing a home 50 miles away or further from any major metropolitan city or plan on purchasing a lot of acreages you may qualify.

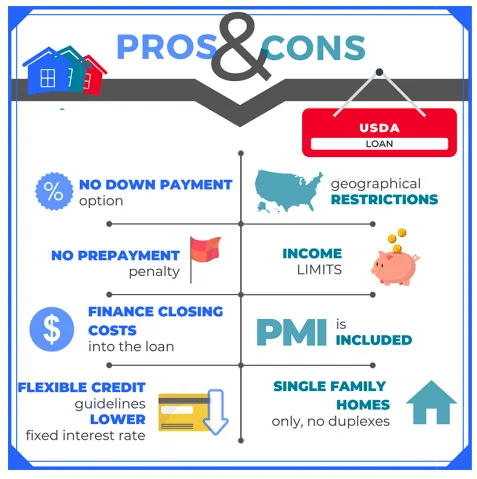

If the home you plan on purchasing is in a USDA location, you have at least a 640 credit score and your household income does not exceed the USDA income limit then you should get a USDA loan.

If you meet all of the requirements for a USDA loan, it is a better option than an FHA simply because a down payment is not required.