Federal Housing Administration (FHA) Loans are backed and insured by the Federal Housing Administration.

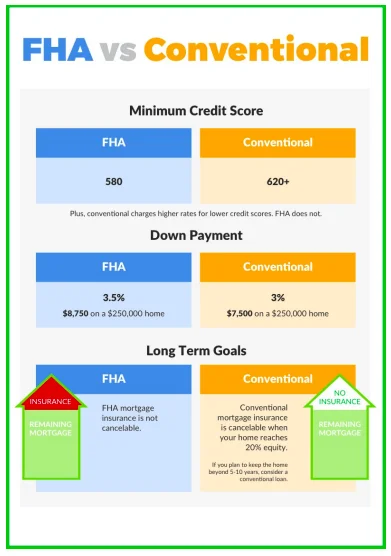

FHA loans have a lower down payment amount with assistance available for those who qualify. Often thought of as a first time homebuyer loan but they’re good for anyone, especially people who have a lower debt-to-income ratio or don’t have a lot of cash in the bank for reserves. FHA loans are also available to people who have a less-than-perfect Credit scores. Credit scores.

Additionally, FHA loans have a shorter time restrictions for people recovering from major credit Issues such as bankruptcy or foreclosure. The time period for an FHA loan is 3 years instead of 7 for foreclosures and 2 years instead of 4 years for bankruptcies.

The appraisal process for an FHA is more stringent than other loans, (but similar to VA loans), requiring the inspector to address any health or safety issues and require repairs or modifications before closing. While this may seem a hindrance, it is a benefit for the Home buyer and helps them to avoid costly repairs or hazards.

FHA Advantages: